Why the Amex White Gold Card Isn’t What You Think

The American Express Gold Card has been a staple for those seeking a balance between rewards and luxury, and now, it’s making waves with a new limited-edition design: the Amex White Gold Card.

While the “White Gold” Card may look like an entirely new offering, it’s essentially the same as the regular Gold Card, just wrapped in a striking new color.

In this article, we’ll explore the features, benefits, and whether the White Gold Card is worth considering, especially with the recent updates to the Gold Card’s perks.

What is the Amex White Gold Card?

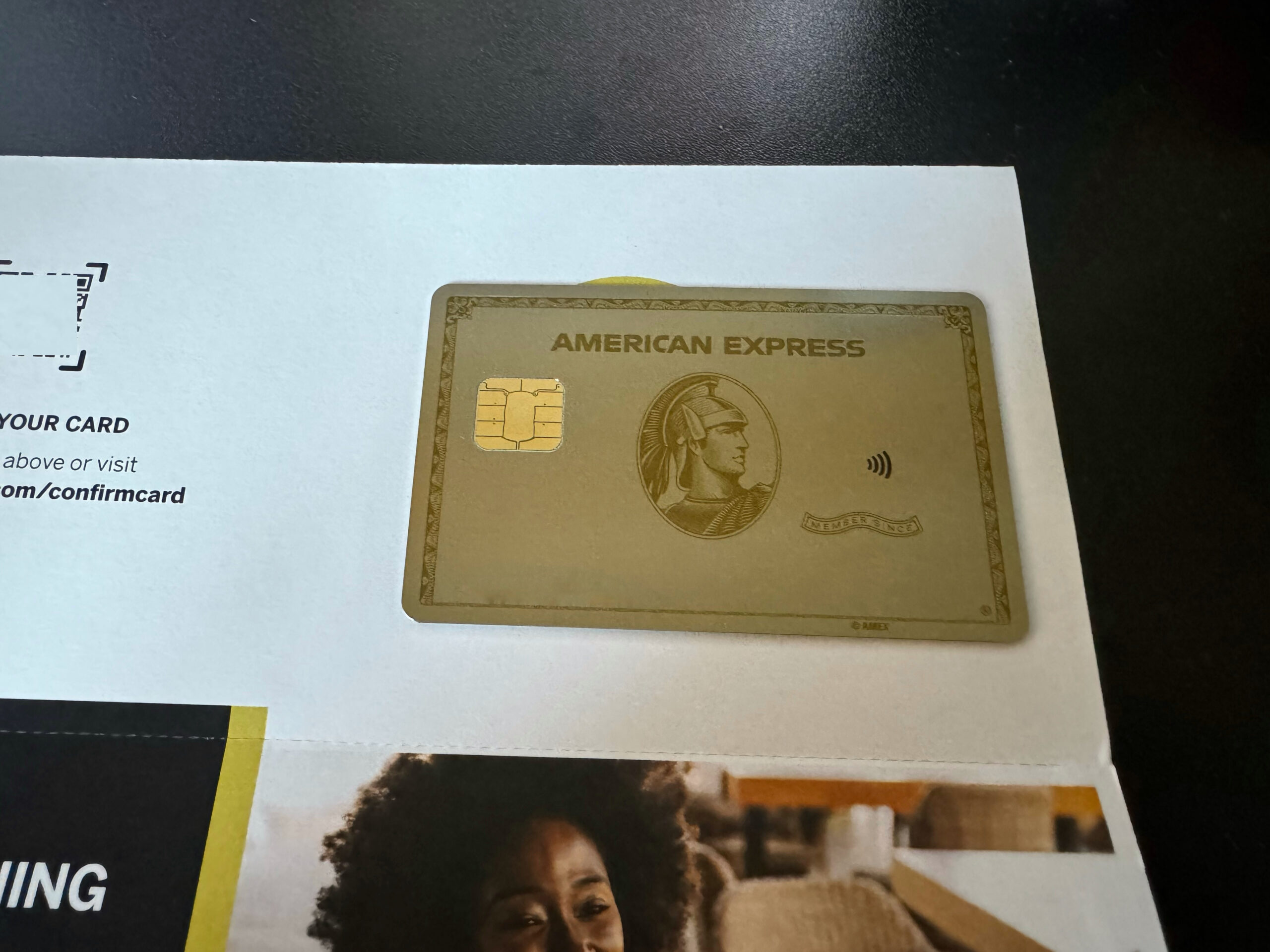

The Amex White Gold Card is a limited-edition version of the standard Gold Card, available while supplies last.

It retains all the same features and benefits of the regular Gold Card, with the only difference being its unique white metal design.

This card is a way for American Express to offer something fresh and exclusive, particularly appealing to those who value aesthetics and exclusivity.

Key Benefits of the Amex White Gold Card

The benefits of the Amex White Gold Card are identical to those of the regular Gold Card, but with some recently introduced enhancements:

- 4X Membership Rewards Points: Cardholders earn 4X points at restaurants worldwide, including takeout and delivery in the U.S., and 4X points at U.S. supermarkets on up to $25,000 in purchases per year.

- New Dining Credits:

- $100 Resy Credit: Up to $100 in annual statement credits ($50 semi-annually) for eligible purchases at U.S. Resy restaurants, Resy.com, and the Resy mobile app.

- $84 Dunkin’ Credit: Up to $84 per year ($7 per month) in statement credits when paying at Dunkin’ locations nationwide.

- Updated $120 Dining Credit: This annual credit now includes Five Guys, in addition to Grubhub, The Cheesecake Factory, wine.com, and Goldbelly.

- $120 Uber Cash: Receive $10 in Uber Cash each month (up to $120 annually) when you add the card to your Uber account, applicable to Uber Eats or Uber Rides in the U.S.

- Expanded Travel Perks: The Hotel Collection now includes over 1,000 properties globally, with more benefits when booking two or more nights through Amex Travel, such as room upgrades, early check-in, late check-out (subject to availability), and a $100 credit for eligible charges.

- 3X Points on Travel: Earn 3X points on flights booked directly with airlines or through Amex Travel.

- No Foreign Transaction Fees: Like the regular Gold Card, the White Gold Card doesn’t charge foreign transaction fees, making it ideal for international travel.

The Reality Behind the White Gold Card

While the Amex White Gold Card offers an eye-catching design and the same robust rewards as the standard Gold Card, there are some factors to consider:

- Limited Edition Design: The main appeal of the White Gold Card is its exclusive, limited-edition design. If aesthetics and the uniqueness of your card are important to you, this may be a significant draw. (We’ll get more with the color later on.)

- Same Benefits, New Look: Apart from its design, the White Gold Card offers no additional perks over the regular Gold Card. All the features, rewards, and credits are identical, so the decision to choose White Gold is purely about appearance.

- Higher Annual Fee: As of July 25, 2024, the annual fee for the Gold Card (and by extension, the White Gold Card) has increased from $250 to $325. This higher fee is something to weigh against the value you’ll derive from the card’s benefits.

The Amex White Gold Card Color Controversy

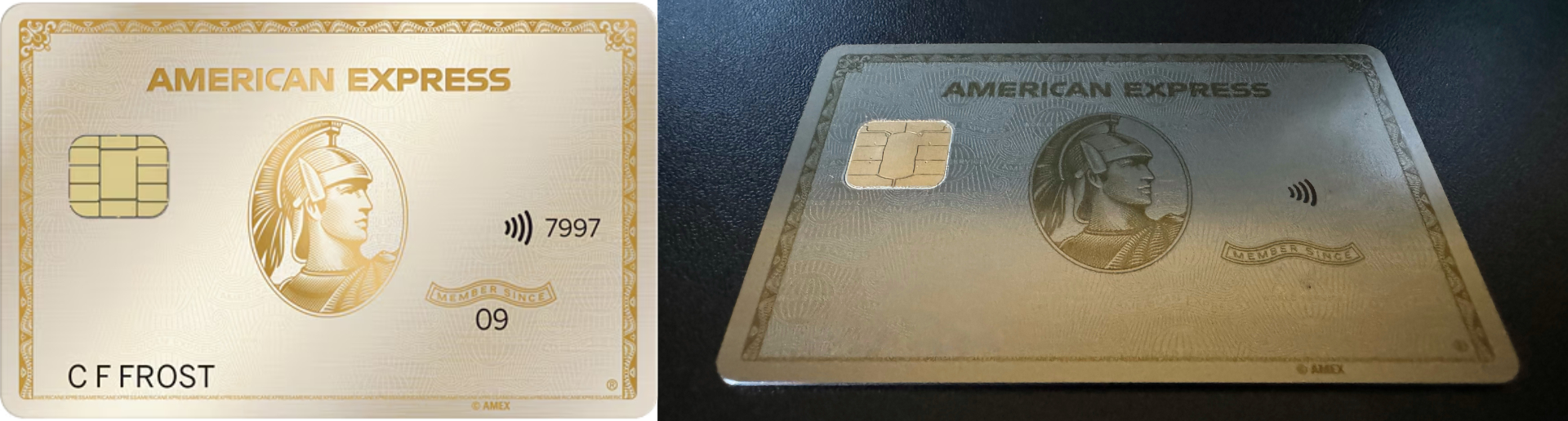

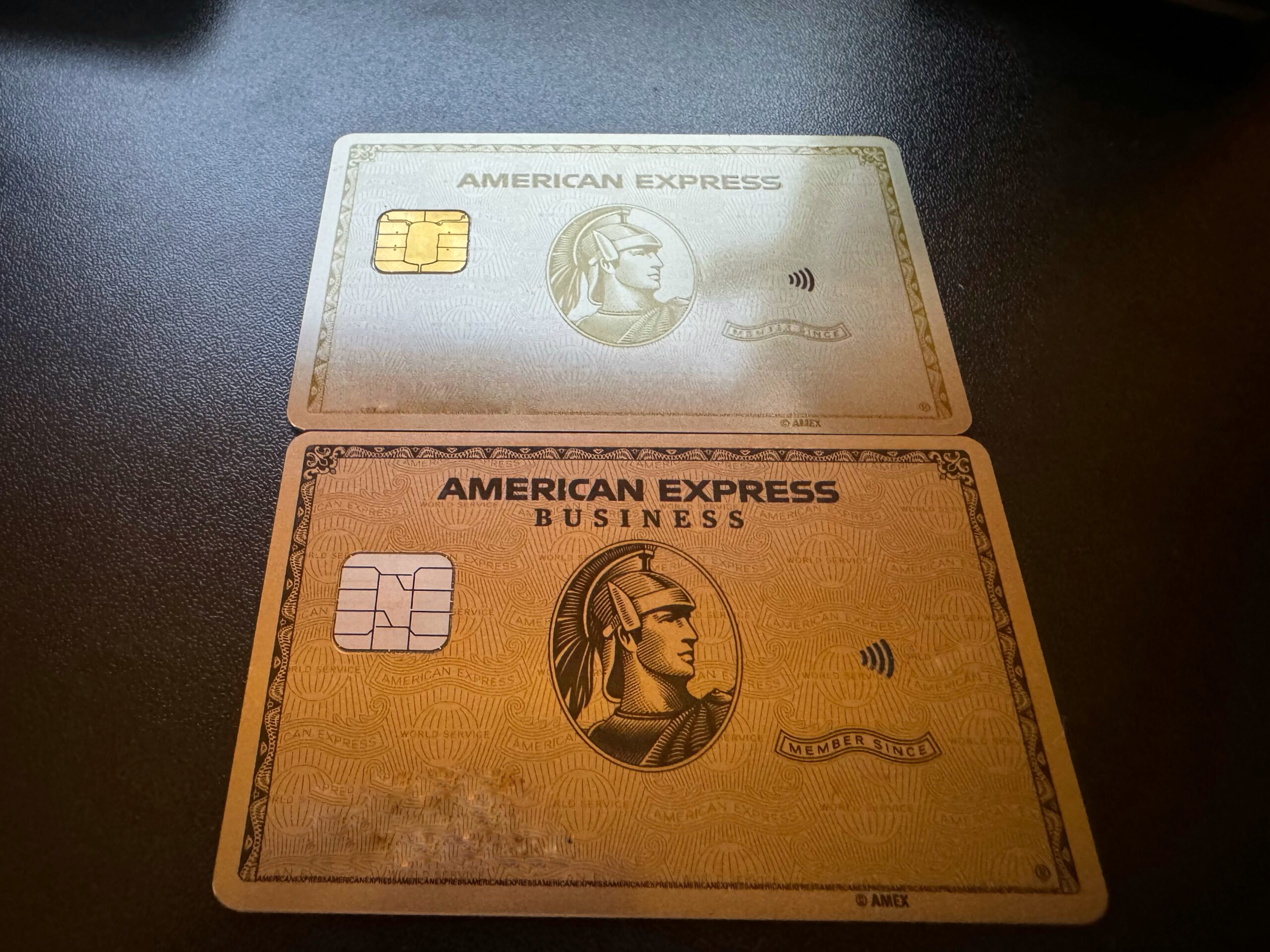

One of the most significant reasons the Amex White Gold Card isn’t what it seems is the discrepancy in its color.

The card’s promotional materials and marketing photos depict a striking, luxurious light gold color, setting expectations for a card that visually stands out.

However, in reality, the card’s color is closer to a gold-tinted version of the Amex Platinum Card, with a subtle difference that’s not immediately noticeable.

This discrepancy can be disappointing for those who were drawn to the card by its advertised appearance, expecting it to stand out in a way that it simply does not.

The real-life version of the White Gold Card is almost indistinguishable from the Amex Platinum Card, and it lacks the distinctiveness that many prospective cardholders might be seeking.

While the Amex White Gold and Platinum cards can be a little bit more distinguishable when viewed from above, it becomes much harder to tell them apart when viewed at an angle, particularly in different lighting conditions or environments.

For those considering the White Gold Card primarily for its aesthetic appeal, it’s crucial to keep in mind that the card may not look as unique in person as it does in promotional images.

This aspect is essential to consider when deciding whether the White Gold Card is the right choice for you, especially if a striking, standout design was a significant factor in your decision.

Amex White Gold Card 100K + 20% Back Statement Credit Sign Up Bonus

One of the most compelling reasons to consider the Amex Gold Card right now is the lucrative sign-up bonus currently being offered.

For a limited time, new cardholders can earn 100,000 Membership Rewards points after spending $6,000 on eligible purchases within the first six months of card membership.

Additionally, you can receive 20% back in statement credits on eligible purchases made at restaurants worldwide within the first six months, up to $100 back. This offer is valid until November 6, 2024.

This generous sign-up bonus was the primary reason I chose to apply for the Amex White Gold Card.

However, it’s important to note that this offer may not be available to everyone by default. If you don’t see this targeted offer in your Amex account, there’s a way to potentially unlock it.

How to Access the 100K + 20% Back Offer:

If you don’t see the offer in your account, try opening an incognito window in your browser and searching for “Amex Gold Card” on Google.

Click on the American Express Gold Card link, and you might be presented with this special offer. If it doesn’t appear, close the incognito window (to clear the browser cache) and try again, possibly on a different device, such as your phone, or on a different IP address by switching to your phone carrier’s internet.

In my case, my Amex account was only showing a 60K points offer for the past few weeks.

However, using the incognito method, I was able to apply for the card and successfully secure the 100K points + 20% back offer. After applying, I linked the card to my Amex account, and the bonus was guaranteed.

Why This Offer Is Worth It:

The combination of 100,000 Membership Rewards points and up to $100 back in statement credits makes this one of the most attractive sign-up bonuses available.

The 100,000 points can be redeemed for a variety of rewards, including travel, statement credits, and more, offering substantial value for new cardholders. The 20% back on restaurant purchases further enhances the appeal, particularly for those who frequently dine out.

If you’re considering the Amex White Gold Card, this sign-up bonus can significantly offset the card’s annual fee and provide a head start in accumulating rewards.

However, be sure to act quickly, as this offer is time-sensitive and may not be available indefinitely.

Why You Should Consider the Amex White Gold Card

Exclusive Design: If having a card that stands out from the standard offerings is important to you, the White Gold Card’s unique appearance might make it worth considering.

Enhanced Dining and Travel Rewards: The new Resy and Dunkin’ credits, along with the expanded dining credit options, add more value for those who frequently dine out or travel.

Comprehensive Travel Perks: The Hotel Collection benefits, coupled with no foreign transaction fees, make this card a strong contender for frequent travelers.

Why the Amex White Gold Card Might Not Be Worth It

Cost vs. Benefits: With the increased annual fee, you’ll need to ensure that the card’s rewards and credits justify the cost. If you don’t maximize these benefits, the fee might not be worth it.

No Additional Features: If you already have the Gold Card, there’s no new benefit to switching to the White Gold Card aside from the design.

Overlapping Benefits: If you hold other premium cards with similar rewards, the White Gold Card may not add much value beyond its aesthetic appeal.

Conclusion

The Amex White Gold Card is an enticing option for those who value aesthetics and exclusivity.

While it offers the same robust rewards and perks as the regular Gold Card, its limited-edition design and exclusive appeal may attract those looking for something different.

However, with the recent increase in the annual fee and the disappointment with the card’s actual color for some cardholders, it’s essential to carefully consider whether the White Gold Card meets your expectations and aligns with your lifestyle.

For some, the White Gold Card will be a perfect fit, while others might find that the regular Gold Card or another option better suits their needs.

Frequently Asked Questions (FAQs)

What is the difference between the Amex White Gold Card and the regular Gold Card?

The only difference is the card’s design. The White Gold Card is a limited-edition variant with the same benefits as the regular Gold Card. However, the color in reality may differ from the promotional images.

Is the Amex White Gold Card worth the higher annual fee?

The new annual fee of $325 is only worth it if you can maximize the card’s dining and travel benefits. Otherwise, the cost might outweigh the rewards.

For me, I would say it’s worth it, since I’ll be using the $120 Uber credit (for Uber Eats), $120 Dining Credit (Cheesecake, Shake Shack, or Five Guys), and the $100 Resy Credit. Which is about $340 worth of credits. Unfortunately, there aren’t many Dunkin Donuts in my area. 🙁

Can existing Gold Cardholders switch to the White Gold Card?

Typically, American Express may allow existing cardholders to switch to the White Gold Card, but availability is limited, and it may depend on current promotions.

Are the new dining credits easy to use?

The new Resy and Dunkin’ credits, along with the updated dining credit, offer more flexibility, but they still have limitations regarding where and how they can be used.

Typically if you don’t live near a Resy restaurant or have a Dunkin Donuts nearby, the increased annual fee may not be worth getting or renewing your American Express Gold Card.

On top of that, if your area doesn’t widely accept or have Uber, Uber Eats, or any of the restaurants that can redeem the Dining Credit, you may wan’t to look at other credit cards.

How long will the White Gold Card be available?

The White Gold Card is available while supplies last, making it a limited-edition offering. Once it’s gone, it may not be reissued.

Who Shouldn’t Get the Amex White Gold Card?

Budget-Conscious Consumers: If the increased annual fee doesn’t fit your budget or you don’t see yourself fully utilizing the card’s perks, this may not be the best choice.

Aesthetic-Conscious Consumers: If the primary appeal for you is the advertised white color, you might be disappointed by the actual look of the card.

Current Gold Cardholders Satisfied with Their Card: If you’re happy with the regular Gold Card and aren’t swayed by the White Gold design, there’s no need to switch.